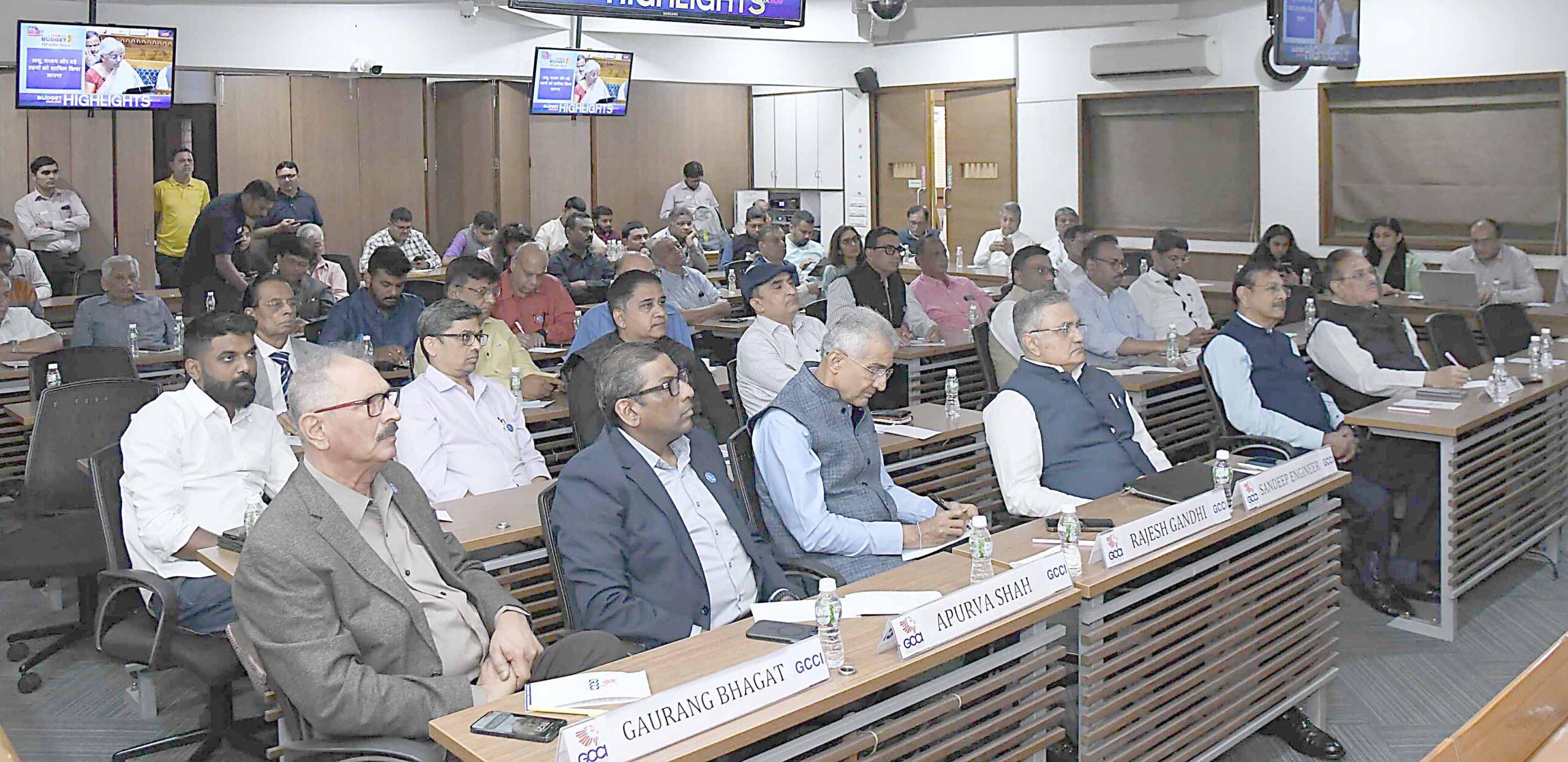

GCCI applauds the Union-Budget 2025-26 announced by Finance Minister

Ahmedabad, On 1st February, 2025, Union Budget was announced by the Hon’ble Union Minister of Finance, Smt. Nirmala Sitharaman.

Shri Sandeep Engineer, President GCCI, in his response to the Union-Budget 2025-26 applauded the union budget. He has stated that the Indian economy has undergone a significant positive transformation in the past decade, paving the way for a hopeful future. He applauds Reducing excessive regulatory burdens, this will help businesses become more efficient, reduce costs, and unlock new growth opportunities. He further mentioned that the budget charts a clear path for India’s economic future, emphasizing industrial growth, social welfare, and infrastructure development. Backed by a strong track record and ambitious goals, the government’s commitment to foster prosperity.

Shri Rajesh Gandhi, Senior Vice President, GCCI has stated that the government has taken significant steps to encourage exports, including the introduction of the Export Promotion Mission with clear sectoral and ministerial targets to enhance access to export credit and provide support for MSMEs in overcoming non-tariff barriers. The launch of a unified digital platform (BharatTradeNet) for trade documentation and financing, will streamline processes and facilitate seamless integration into global supply chains. These initiatives reflect a strategic commitment to strengthening India’s position in the global marketplace and promoting sustainable export growth.

Shri Apurva Shah, Vice President, GCCI, praised the recent budget’s exemption of import duties on shuttle-less looms, which will enhance domestic manufacturing in agro-textiles, medical textiles, and geo-textiles, reducing reliance on imports from China and Vietnam. The budget also addresses India’s dependence on imported Extra Long Staple (ELS) cotton by launching a five-year mission to improve domestic cotton production, especially ELS varieties and cotton yields. These efforts will benefit the textile sector and other industries, as cotton oil production will increase thereby reducing oil import cost. Additionally, cotton by-products can be used as livestock fodder, promoting sustainable agriculture and supporting animal husbandry.

GCCI Hon. Secretary, Shri Gaurang Bhagat applauded the Union Budget for increasing the tax deduction limit for senior citizens from ₹50,000 to ₹1 lakh and raising the TDS limit on rent from ₹2.40 lakh to ₹6 lakh. These changes, along with the income tax exemption for salaried individuals earning up to ₹12,75,000, aim to provide financial relief and boost middle-class purchasing power. He also applauded exempting withdrawals from long-term NSS accounts, where interest is no longer payable, starting 29th August 2024 and thanked Hon’ble Union Minister of Finance for accepting GCCI’s request.

GCCI President and his team of office bearers especially highlighted and applauded below mentioned key positive initiatives undertaken in the Union Budget:

- MSME classification will be increased by 2.5 times, and turnover limits will be doubled, promoting technological upgradation and better access to capital.

- Credit guarantee cover for Micro and Small Enterprises increased from ₹5 crore to ₹10 crore, unlocking an additional ₹1.5 lakh crore credit over the next five years.

- Startups will see an increase in guarantee cover from ₹10 crore to ₹20 crore, with a moderated 1% guarantee fee for loans in 27 focus sectors under Atmanirbhar Bharat. This policy supports the dynamic growth of startups, offering them the resources needed to thrive.

- Exporter MSMEs will receive credit support for term loans up to ₹20 crore. This initiative will strengthen MSME exporters and enhance India’s global trade presence.

- Customized Credit Cards with a ₹5 lakh limit will be introduced for Udyam-registered micro enterprises, with 10 lakh cards to be issued in the first year. This initiative will provide micro enterprises with convenient access to credit, enabling better financial management.

- A scheme for 5 lakh women, SC, and ST first-time entrepreneurs will be launched. This will empower underrepresented groups, fostering inclusivity in entrepreneurship. It will provide term loans up to ₹2 crore over the next five years, integrating lessons from the Stand-Up India scheme.

- Under the National Action Plan for Toys, a dedicated scheme will develop clusters, skills, and a manufacturing ecosystem to make India a global toy hub. This initiative will establish India as a key player in the global toy manufacturing market. This will Focus on high-quality, innovative, and sustainable ‘Made in India’ toys. This will enhance the global reputation of Indian toys for their quality and innovation.

- A National Manufacturing Mission will be established to support small, medium, and large industries under “Make in India.” This mission will create a robust manufacturing ecosystem that nurtures both large and small industries.

- The mission will provide policy support, execution roadmaps, governance, and monitoring frameworks at both central and state levels. This initiative will strengthen India’s manufacturing sector, boosting its competitiveness globally.

- The mission will also focus on Clean Tech Manufacturing, promoting domestic value addition in key areas such as: Solar PV cells, EV batteries, motors, and controllers, Electrolyzers, Wind turbines, High-voltage transmission equipment, and Grid-scale batteries. This will ensure that India leads in clean energy and sustainable manufacturing, contributing to a greener economy.

- A 5-year mission will facilitate significant improvements in productivity and sustainability of cotton farming, promoting extra-long staple cotton varieties. This mission will support cotton farmers and enhance India’s cotton industry with sustainable practices.

- A plant with an annual capacity of 12.7 lakh metric tons will be set up at Namrup, Assam. This will ensure the steady supply of urea for agricultural growth in the region.

- 200 Centres will be established in 2025-26 in district hospitals across the country. This will improve access to cancer treatment and care for people in rural areas.

- The deadline to file updated tax returns has been extended from 2 years to 4 years. This will offer taxpayers more flexibility and ease in complying with tax obligations.

- A comprehensive social security scheme will be introduced for GIG workers, ensuring healthcare benefits and assistance for 1 crore workers.

- Top 50 tourist destination sites in the country will be developed in partnership with states through a challenge mode.

- A focus on medical tourism will be promoted in partnership with the private sector, along with easier visa norms. This will position India as a leading destination for medical tourism.

- Export Promotion Mission to be launched with sectoral and ministerial targets, jointly driven by the Ministries of Commerce, MSME, and Finance.

- Exemptions were announced from basic customs duty (BCD) for 36 life-saving drugs and 35 additional capital goods for EV manufacturing. These exemptions will ensure critical sectors have the resources to grow, particularly the healthcare and EV industries.