Aye Finance Delivers Exceptional Performance Across Key Metrics in FY 2023-24

Profit grew 3X to INR 161 Cr, AUM grows to INR 4400 Crores with Net NPA of under 1%

Ahmedabad, 25th July, 2024: Aye Finance, a category leader providing working capital and fixed capital to underserved micro enterprises across India, has announced outstanding financial performance for the fiscal year ending March 31, 2024 (FY 2023-24).

In FY 2023-24, Aye Finance reported remarkable growth across key financial metrics. The company’s profit after tax grew nearly threefold to INR 161 Crores, up from INR 57 crores in the previous year, showcasing its robust business model and operational efficiency. Revenue saw a significant increase of 67%, soaring to INR 1072 crores compared to INR 643.34 crore in FY 2022-23. This substantial revenue growth reflects the company’s expanding market presence and the increasing demand for its financial products among micro enterprises.

Aye Finance’s Assets under Management (AUM) also witnessed a remarkable increase, rising to INR 4400 crores from INR 2700 crores in FY23. This growth in AUM demonstrates the company’s ability to scale its lending operations while maintaining asset quality. Notably, the lender kept its Net NPA under 1%, highlighting its strong risk management practices. The majority of Aye’s portfolio is secured by hypothecation of assets and mortgage, further bolstering its financial stability.

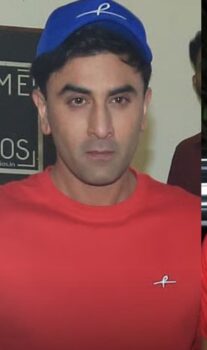

Sanjay Sharma, Managing Director of Aye Finance, commented on the company’s performance, , “Our exceptional performance in FY 2023-24 is a testament to the resilience of our business model, the hard work put in by our team, and the trust placed in us by our valued customers. Our growth is built on a stable market of micro MSE segment. We remain committed to empowering MSEs, fostering financial inclusion, and contributing to the overall economic development of the country. As we look ahead, we are well-positioned to capitalize on the vast growth opportunities and further strengthen our position as a leading provider of innovative financial solutions for this vital segment.”

Since its inception in 2014, Aye Finance has made significant strides in addressing the funding challenges of the micro enterprise sector. The company has disbursed over INR 10,000 crores to more than 9 lacs businesses, demonstrating its substantial impact on the MSME landscape in India. Aye’s success can be attributed to its unique cluster-based credit methodology for risk assessment, product suite tailored to specific needs of micro enterprises, and robust risk management and governance policies.

With a strong financial performance and latest funding, Aye Finance is well-positioned to cement its leadership in the MSME lending space. The company aims to create far-reaching socioeconomic impact by catalyzing entrepreneurship and driving financial empowerment at the grassroots level across India. Looking ahead, Aye Finance is poised to capitalize on vast growth opportunities and further strengthen its position as a leading provider of innovative financial solutions for the vital MSME segment.