Gross GST revenue collection in May 2024 stands at ₹1.73 lakh crore;

₹3.83 lakh crore gross GST revenue collection in FY2024-25 (till May 2024) records 11.3% y-o-y growth

Net Revenue (after refunds) grows 11.6% in FY 2024-25 (till May 2024)

Domestic Gross GST Revenue grows 15.3% in May, 2024

Breakdown of May 2024 Collections:

- Central Goods and Services Tax (CGST): ₹32,409 crore;

- State Goods and Services Tax (SGST): ₹40,265 crore;

- Integrated Goods and Services Tax (IGST): ₹87,781 crore, including ₹39,879 crore collected on imported goods;

- Cess: ₹12,284 crore, including ₹1,076 crore collected on imported goods.

The gross GST collections in the FY 2024-25 till May 2024 stood at ₹3.83 lakh crore. This represents an impressive 11.3% year-on-year growth, driven by a strong increase in domestic transactions (up 14.2%) and marginal increase in imports (up 1.4%). After accounting for refunds, the net GST revenue in the FY 2024-25 till May 2024 stands at ₹3.36 lakh crore, reflecting a growth of 11.6% compared to the same period last year.

Breakdown of collections in the FY 2024-25 till May, 2024, are as below:

- Central Goods and Services Tax (CGST): ₹76,255 crore;

- State Goods and Services Tax (SGST): ₹93,804 crore;

- Integrated Goods and Services Tax (IGST): ₹1,87,404 crore, including ₹77,706 crore collected on imported goods;

- Cess: ₹25,544 crore, including ₹2,084 crore collected on imported goods.

Inter-Governmental Settlement:

In the month of May, 2024, the Central Government settled ₹38,519 crore to CGST and ₹32,733 crore to SGST from the net IGST collected of ₹67,204 crore. This translates to a total revenue of ₹70,928 crore for CGST and ₹72,999 crore for SGST in May, 2024, after regular settlement.

Similarly, in the FY 2024-25 till May 2024 the Central Government settled ₹88,827 crore to CGST and ₹74,333 crore to SGST from the net IGST collected of ₹154,671 crore. This translates to a total revenue of ₹1,65,081 crore for CGST and ₹1,68,137 crore for SGST in FY 2024-25 till May 2024 after regular settlement.

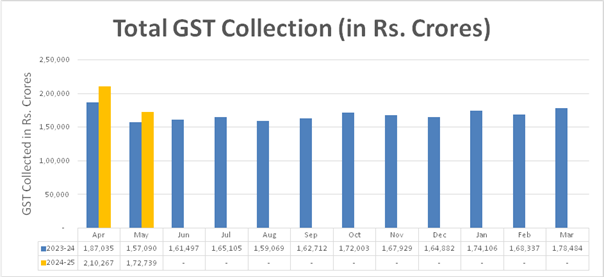

The chart below shows trends in monthly gross GST revenues during the current year. Table-1 shows the state-wise figures of GST collected in each State during the month of May, 2024 as compared to May, 2023. Table-2 shows the state-wise figures of post settlement GST revenue of each State for the month of May, 2024.

Chart: Trends in GST Collection

Table 1: State-wise growth of GST Revenues during May, 2024[1]