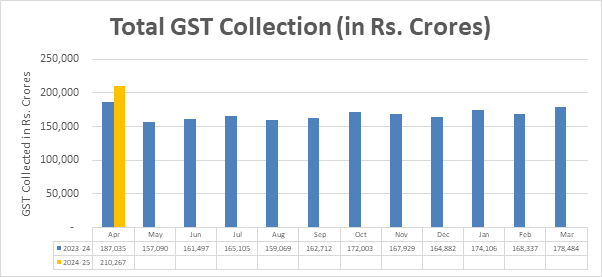

GST revenue collection for April 2024 highest ever at Rs 2.10 lakh crore

GST collections breach landmark milestone of ₹2 lakh crore

Gross Revenue Records 12.4% y-o-y growth -Net Revenue (after refunds) stood at ₹1.92 lakh crore; 15.5% y-o-y growth

The Gross Goods and Services Tax (GST) collections hit a record high in April 2024 at ₹2.10 lakh crore. This represents a significant 12.4% year-on-year growth, driven by a strong increase in domestic transactions (up 13.4%) and imports (up 8.3%). After accounting for refunds, the net GST revenue for April 2024 stands at ₹1.92 lakh crore, reflecting an impressive 15.5% growth compared to the same period last year.

Positive Performance Across Components:

Breakdown of April 2024 Collections:

- Central Goods and Services Tax (CGST): ₹43,846 crore;

- State Goods and Services Tax (SGST): ₹53,538 crore;

- Integrated Goods and Services Tax (IGST): ₹99,623 crore, including ₹37,826 crore collected on imported goods;

- Cess: ₹13,260 crore, including ₹1,008 crore collected on imported goods.

Inter-Governmental Settlement: In the month of April, 2024, the central government settled ₹50,307 crore to CGST and ₹41,600 crore to SGST from the IGST collected. This translates to a total revenue of ₹94,153 crore for CGST and ₹95,138 crore for SGST for April, 2024 after regular settlement.

The chart below shows trends in monthly gross GST revenues during the current year. Table-1 shows the state-wise figures of GST collected in each State during the month of April, 2024 as compared to April, 2023. Table-2 shows the state-wise figures of post settlement GST revenue of each State for the month of April, 2024.

Chart: Trends in GST Collection