Swiggy Limited’s IPO to open on November 06, 2024

- Price Band fixed at ₹ 371 per equity share to ₹ 390 per equity share of the face value of ₹ 1 each (“Equity Shares”) of Swiggy Limited (the “Company”)

- Anchor Investor Bidding Date – Tuesday, November 05, 2024

- Bid /Offer Opening Date – Wednesday, November 06, 2024, and Bid/ Offer Closing Date – Friday, November 08, 2024

- Bids can be made for a minimum of 38 Equity Shares and in multiples of 38 Equity Shares thereafter

- For further details, please also see price band advertisement shared as an attachment or view price band advertisement published in Financial Express newspaper dated October 30, 2024 on page no 26.

Ahmedabad | October 31, 2024: Swiggy Limited (the “Company”), proposes to open its initial public offering (“Offer”) on Wednesday, November 06, 2024. Bid/ Offer Closing Date will be Friday, November 08, 2024. Anchor Investor Bidding Date is one Working Day prior to Bid/Offer Opening Date, that is, Tuesday, November 05, 2024.

The Price Band of the Offer has been fixed from ₹ 371 per Equity Share to ₹ 390 per Equity Share. Bids can be made for a minimum of 38 Equity Shares and in multiples of 38 Equity Shares thereafter.

The Offer comprises of a Fresh Issue of Equity Shares aggregating up to ₹ 44,990 million (the “Fresh Issue”) and an offer for sale of up to 175,087,863 equity shares (the “Offer for Sale”) by the Selling Shareholders. .

The Offer includes a reservation of up to 750,000 equity shares of face value of ₹1 each, aggregating up to ₹[•] million, for subscription by eligible employees not exceeding 5% of our post-offer paid-up equity share capital (the “Employee Reservation Portion”). The Offer less the Employee Reservation Portion is hereinafter referred to as the Net Offer.

The Equity Shares offered through the Red Herring Prospectus are proposed to be listed on BSE Limited (“BSE”) and National Stock Exchange of India Limited (“NSE”).

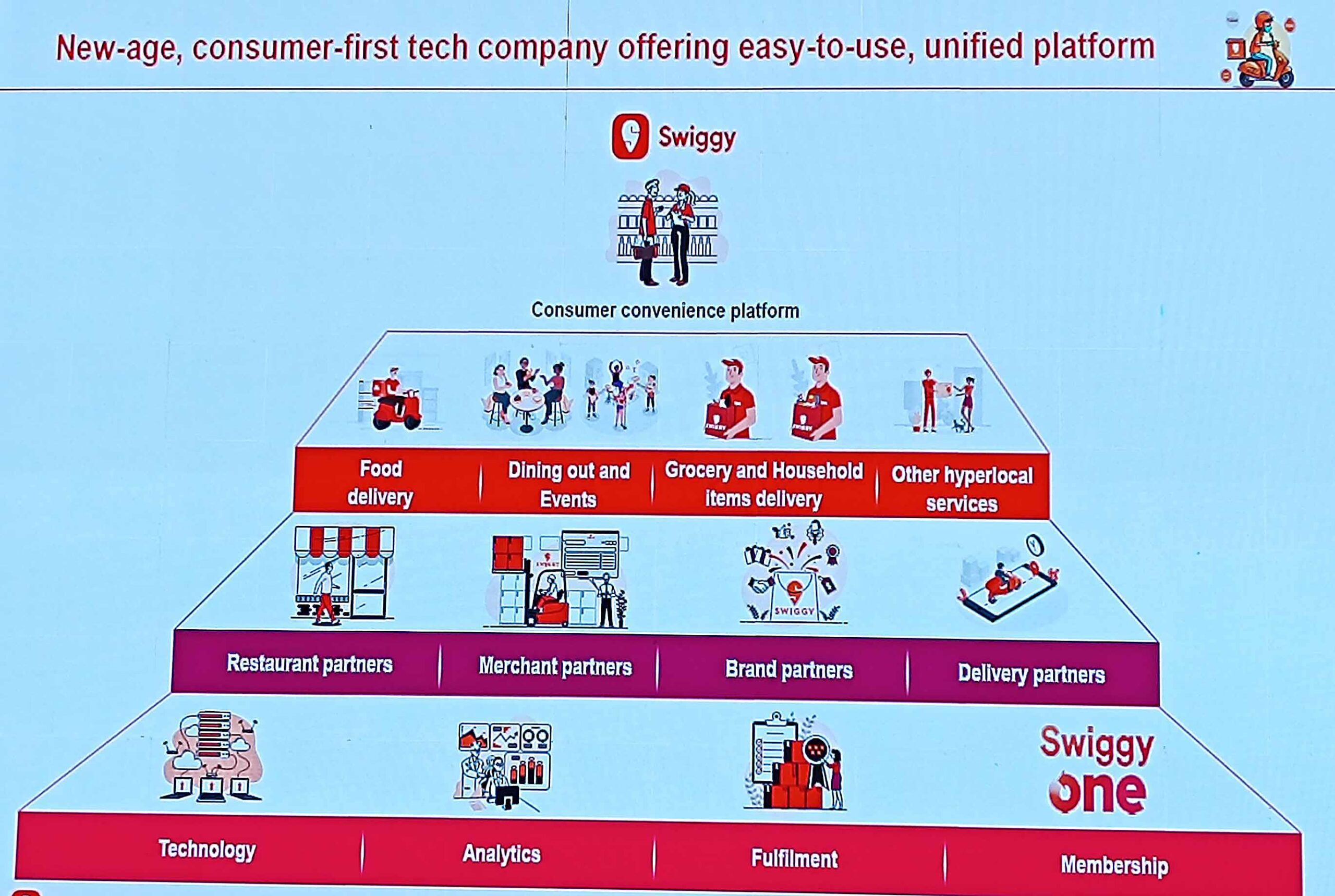

Swiggy is one of the most valued new-age consumer brands to tap the Indian capital market. The company’s Rs 11,300-crore IPO is a combination of fresh issue of shares worth Rs 4,500 crore and an offer for sale (OFS) of Rs 6,800 crore, they added.

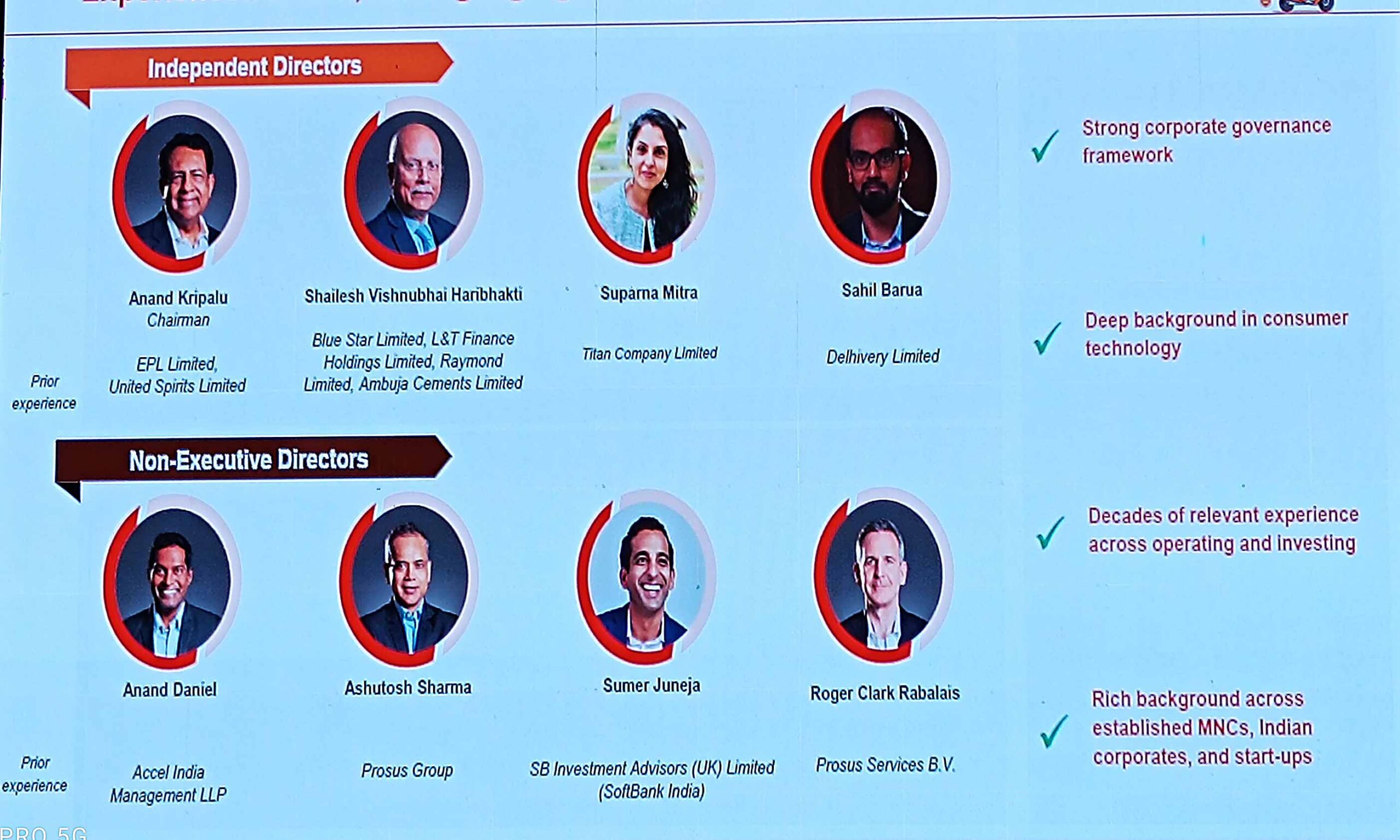

Those selling shares in the OFS route are — Accel India IV (Mauritius) Ltd, Apoletto Asia Ltd, Alpha Wave Ventures, LP, Coatue PE Asia XI LLC, DST EuroAsia V B.V, Elevation Capital V Ltd, Inspired Elite Investments Ltd, MIH India Food Holdings B.V, Norwest Venture Partners VII-A Mauritius and Tencent Cloud Europe B.V.

Early investors like Accel, Elevation Capital and Norwest Ventures are making up to 35 times in returns on the portion they decided to sell. On the other hand, SoftBank continues to stay invested.

Going by the IPO papers, proceeds from the fresh issue to the tune of Rs 137.41 crore will be used for debt payment of subsidiary Scootsy.

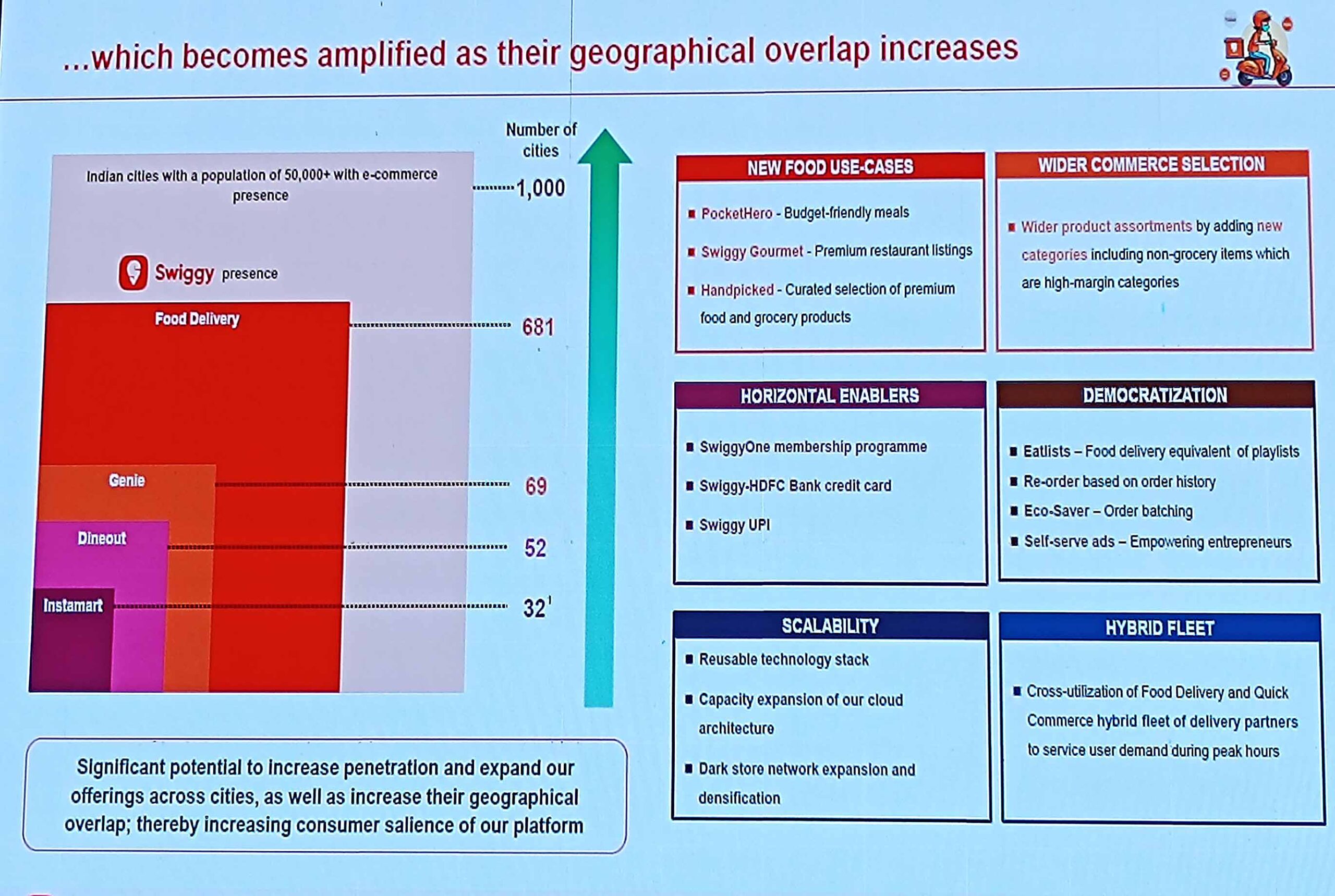

Additionally, Rs 982.40 crore will be invested in Scootsy for expanding the Dark Store network in the quick commerce segment, with Rs 559.10 crore allocated for setting up dark stores and Rs 423.30 crore for lease or licence payments.

The company will also invest Rs 586.20 crore in technology and cloud infrastructure, Rs 929.50 crore for brand marketing and business promotion, and funds will be allocated for inorganic growth and general corporate purposes.

This is an Offer in terms of Rule 19(2)(b) of the SCRR read with Regulation 31 of the SEBI ICDR Regulations. This Offer is being made through the Book Building Process in compliance with Regulation 6(2) of the SEBI ICDR Regulations wherein not less than 75% of the Net Offer shall be available for allocation on a proportionate basis to Qualified Institutional Buyers (“QIBs” and such portion the “QIB Portion”) provided that our Company and Selling Shareholders, in consultation with the BRLMs, may allocate up to 60% of the QIB Portion to Anchor Investors on a discretionary basis in accordance with the SEBI ICDR Regulations (“Anchor Investor Portion”), of which one-third shall be reserved for domestic Mutual Funds, subject to valid Bids being received from domestic Mutual Funds at or above the price at which Equity Shares will be allocated to the Anchor Investors (“Anchor Investor Allocation Price”), in accordance with the SEBI ICDR Regulations. In the event of under-subscription or non-allocation in the Anchor Investor Portion, the balance Equity Shares shall be added to the QIB Portion (excluding the Anchor Investor Portion) (“Net QIB Portion”).

Further, 5% of the Net QIB Portion shall be available for allocation on a proportionate basis to Mutual Funds only and the remainder of the Net QIB Portion shall be available for allocation on a proportionate basis to all QIBs (other than Anchor Investors) including Mutual Funds, subject to valid Bids being received at or above the Offer Price. If at least 75% of the Net Offer cannot be Allotted to QIBs, then the entire Bid Amount (as defined hereinafter) will be refunded forthwith.

However, if the aggregate demand from Mutual Funds is less than 5% of the Net QIB Portion, the balance Equity Shares available for allocation in the Mutual Fund Portion will be added to the remaining QIB Portion for proportionate allocation to QIBs. Further, not more than 15% of the Net Offer shall be available for allocation to Non-Institutional Bidders (“NIBs”) of which (a) one third portion shall be reserved for NIBs with application size of more than ₹200,000 and up to ₹1,000,000; and (b) two-thirds of the portion shall be reserved for NIBs with application size of more than ₹1,000,000, provided that the unsubscribed portion in either of such sub-categories may be allocated to Bidders in other sub-category of the NIBs in accordance with SEBI ICDR Regulations, subject to valid Bids being received above the Offer Price and not more than 10% of the Net Offer shall be available for allocation to Retail Individual Bidders (“RIB”) in accordance with the SEBI ICDR Regulations, subject to valid Bids being received from them at or above the Offer Price. Further, Equity Shares will be allocated

on a proportionate basis to Eligible Employees applying under the Employee Reservation Portion, subject to valid Bids being received from them at or above the Offer Price. All Bidders (except Anchor Investors) are required to mandatorily utilise the Application Supported by Blocked Amount (“ASBA”) process by providing details of their respective ASBA accounts and UPI ID (in case of UPI Bidders (defined hereinafter) using the UPI Mechanism), in which case the corresponding Bid Amounts will be blocked by the SCSBs or under the UPI Mechanism, as applicable to participate in the Offer. Anchor Investors are not permitted to participate in the Anchor Investor Portion of the Offer through the ASBA process. For details, see “Offer Procedure” beginning on page 445 of the Red Herring Prospectus.

Kotak Mahindra Capital Company Limited, J.P. Morgan India Private Limited, Citigroup Global Markets India Private Limited, BofA Securities India Limited, Jefferies India Private Limited, ICICI Securities Limited and Avendus Capital Private Limited are the book running lead managers (“Book Running Lead Managers” or “BRLMs”) to the Offer.