All Gujarat Federation of Tax Consultants and Income Tax Bar Association jointly organized Two Day Tax Conclave

Ahmedabad, All Gujarat Federation of Tax Consultants: It is the apex state tax professionals’ body in Gujarat with individual & institutional members having more than 30 institutional members representing entire Gujarat region.

Income Tax Bar Association: one of the oldest tax bar associations in India having more than 1200 members comprising of Chartered Accountants, Tax Advocates and Tax Practitioners.

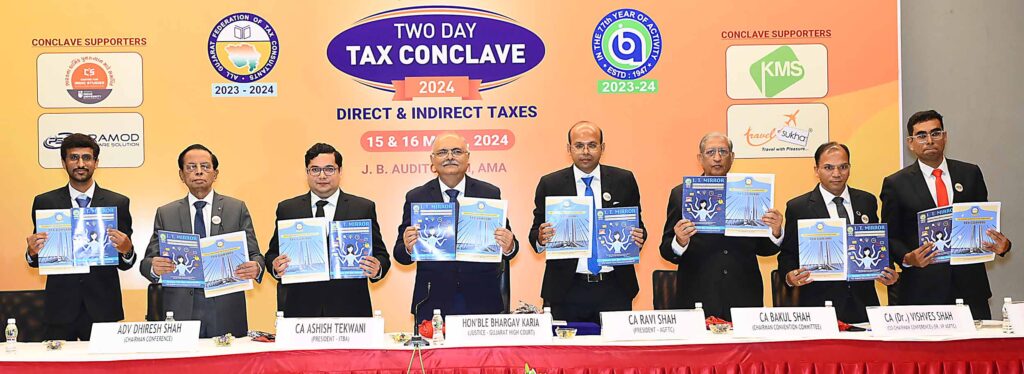

Both the associations have jointly organized Two Day Tax Conclave, 2024 on 15th & 16th March, 2024, which is the Fifth Consecutive Tax Conclave on Direct & Indirect Taxes. The conclave is being held at J B Auditorium, AMA, where experts in the field of Direct & Indirect Taxes from across the country are coming to share knowledge with the participants.

The Conclave was inaugurated by Hon. Justice Bhargav Karia, Gujarat High Court. He addressed the conclave and guided the participants about the History of Taxation and what are the observations of the Judiciary in the current litigations. He guided the members what can be done in current scenario so that the litigations can be resolved at the earlier stages and thereby increasing the tax compliance and reducing the burden on the tax professionals and assessee.

The 1st Technical Session was addressed by Dr. (CA) Girish Ahuja, one of the leading Direct Tax Experts of the Country on Recent Contemporary Issues on Taxation of Charitable Trusts. He deliberated upon the issues of registration of trust, the issues of the demand raised on the trust and the technical difficulties faced at the time of registration and filling of returns of the trust. He guided the participants about care to be taken so that unnecessary difficulties are avoided. The participants immensely benefited from the session. He answered the questions of the participants for more than half hour regarding the difficulties faced by the participants.

The 2nd Technical Session was addressed by CA A Jatin Christopher. He guided the members on how to draft the replies to GST Show Cause Notices. The practical aspects to be undertaken at the time of filing the replies were discussed in depth. Various issues relating to the GST Appeals were also deliberated. He guided the members in relation to drafting of appeal, filing of the submissions and care to be taken while filling the submissions relating to GST appeals.

The 3rd Technical Session was addressed by Adv (CA) Dhinal Shah. Gujarat is the land of Non-Resident Indians. The most relevant issues relating to NRI taxation were addressed by him. He gave practical case study regarding the various issues faced in NRI Taxation. Along with it, the implications of FEMA laws on the NRI Transactions were discussed.

The Brain Trust on Direct Taxes was the final Session of the day. The Brain Trustees Adv. Mehul Patel, CA Mehul Thakkar, CA Aseem Thakkar & CA Mitish Modi discussed the various practical questions faced by the members. The various controversies in the field of Taxation were dissected and deliberated by the Brain Trustees. On the said occasion the Chief Guest unveiled the publications of both the associations being, the Tenth Edition of I.T. Mirror, Mouthpiece of Income Tax Bar Association, a special edition contributed by Women Professionals dedicated to Women in the month of International Women’s Day.

The said edition has been forwarded by Hon. Vice Chancellor of Gujarat University and Gujarat Technical University. Also, the Annual Edition of Tax Gurjari covering Direct Tax, Indirect Tax & GIFT City published by AGFTC was unveiled simultaneously.